Trading Ideas $HIMZ / Hims Telehealth

- UltraAlgo Trader

- Oct 18

- 2 min read

Algorithmic Trading for Stocks

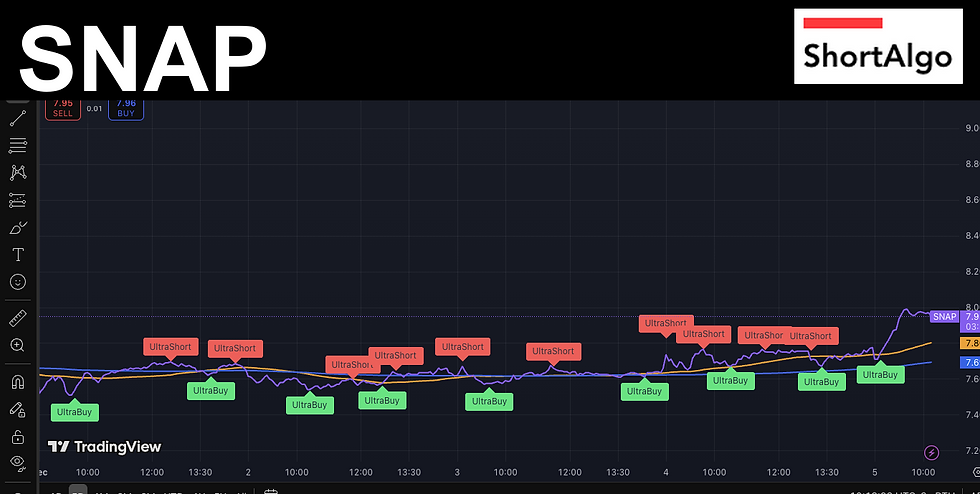

HIMZ (Defiance Daily Target 2X Long HIMS ETF) delivered a classic momentum burst followed by a sharp trend break—exactly the kind of sequence active traders look for. On the 5-minute chart, price accelerated from a base near the mid-$19s into a parabolic run that peaked just shy of the high-$27s/$28 area before rolling over. A fast moving average (orange) tracked the impulse move while the slower moving average (blue) lagged—and their subsequent bearish crossover aligned with a waterfall decline into the high-$17s.

This page walks through what just happened, why it matters, and how to frame the next trading decisions with clear levels, invalidations, and example playbooks.

Key Takeaways

Structure: Strong markup phase → exhaustion near ~28 → distribution → trend break.

Signal cluster: Bearish MA crossover and “UltraShort” prints coincided with lower highs—high-probability reversal context.

Levels that matter now: $21.40–$22.60 as a pivotal supply band; $17.80–$18.10 as first demand.

Bias (short term): Bearish until price reclaims and holds above the blue MA and the $21.40–$22.60 band.

Market Context & Instrument Nuance

HIMZ is a 2× leveraged vehicle tied to HIMS. Intraday swings frequently exaggerate underlying moves, which is advantageous for tactical setups but demands tighter risk controls. Expect amplified moves around inflection points and respect the possibility of extended runs in both directions.

Recent Price Action: From Breakout to Breakdown

Markup & Momentum: After an “UltraBuy” cluster near the lows, price stair-stepped higher with shallow pullbacks, hugging the fast MA (orange). This behavior is typical of trend days where dip-buyers anchor risk to the fast average.

Climax & Fade: A vertical push into the high-$27s/$28 printed a local exhaustion tag (“UltraShort” at the top). The first lower high after that tag was the canary.

Structure Violation: Once price closed below the fast MA and failed the next retest, control shifted. The decisive tell was the fast/slow MA bear cross (orange below blue) near the mid-$23s—followed by cascading sell pressure into the high-$17s.

Moving Averages: What They’re Saying Now

Fast MA (orange): Sloped down aggressively—sign of momentum sellers in control.

Slow MA (blue): Rolling over; serves as dynamic resistance on bounces.

Trading implication: Until price reclaims the blue MA and holds above it, rallies are guilty-until-proven-innocent. UltraAlgo delivers clear buy and short signals on any security listed across all major exchanges (NYSE, NASDAQ, CBOE, TSX, LSE), including forex and crypto. A free trial is available at no risk.

Join our Community with over 30,000 active traders. Our team posts thousands of trading ideas daily covering both interday and intraday trading opportunities.