Understanding A Traders New Guide

- AI Trader

- Dec 31, 2023

- 3 min read

Updated: Jan 2, 2024

As a new trader in the world of stock trading, it's essential to understand the various dynamics that can impact stock prices and trading strategies. One such phenomenon that has gained attention in recent times is the gamma squeeze. For novice traders looking to navigate this complex landscape, having the right tools and knowledge at their disposal can make a significant difference in their trading success. This article aims to provide a comprehensive overview of the gamma squeeze phenomenon and how the UltraAlgo algorithmic trading platform, powered by AI and designed for quick and easy backtesting, can empower traders to navigate and capitalize on market movements.

Gamma Squeeze

The term gamma squeeze refers to a market situation where the buying of options, particularly call options, leads to a chain reaction of hedging activity by options market makers. It occurs when a surge in call option buying forces market makers to buy more shares of the underlying stock to hedge their exposure, thereby driving the stock price higher. This creates a feedback loop where the rising stock price triggers more options buying, further exacerbating the squeeze.

Gamma squeeze situations are often associated with high volatility and rapid price movements, making them both challenging and potentially lucrative for traders. Understanding and identifying gamma squeezes can provide valuable trading opportunities, but it requires a keen knowing of options dynamics and market behavior.

Power of UltraAlgo Algorithmic Trading Platform

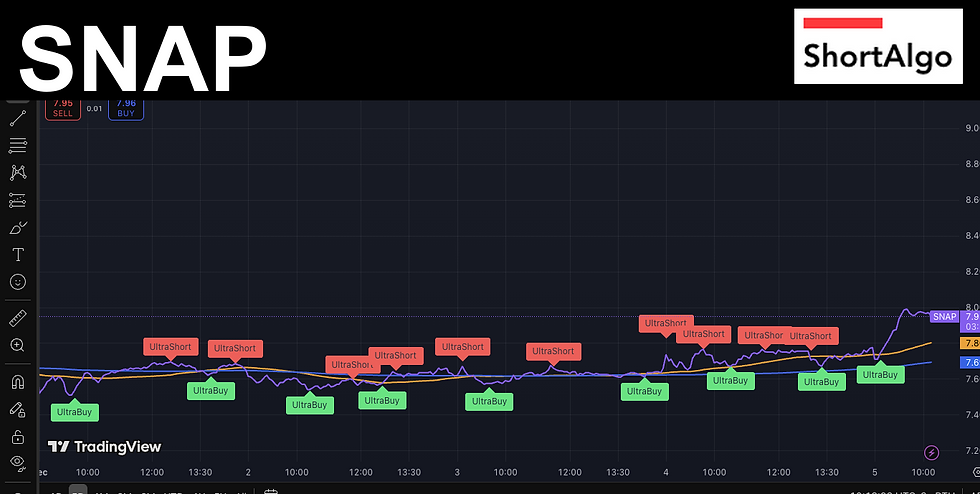

UltraAlgo offers an advanced algorithmic trading platform that caters to traders across various asset classes, including stocks, ETFs, options, and forex. Designed and built by professional traders, UltraAlgo leverages 15 technical indicators and powerful AI capabilities to help traders make informed trading decisions and execute strategies with precision.

For novice traders seeking to navigate the complexities of a gamma squeeze, UltraAlgo's backtesting feature can be invaluable. Backtesting allows users to simulate their trading strategies using historical data, enabling them to assess the performance of their strategies and make informed adjustments before applying them to live markets. This feature can be particularly useful when formulating strategies to capitalize on potential gamma squeeze opportunities.

Additionally, UltraAlgo's AI-powered predictive analytics can analyze market data and identify patterns that may indicate imminent gamma squeezes. By leveraging this technology, traders can stay ahead of market movements and position themselves strategically to benefit from potential gamma squeeze scenarios.

Navigating Gamma Squeeze with UltraAlgo

For a novice trader, navigating a gamma squeeze can be daunting without the right tools and knowledge. With UltraAlgo’s user-friendly interface and comprehensive technical indicators, traders can monitor options market activity, stock price movements, and options chain data to identify potential gamma squeeze situations. The platform's real-time market data updates and visual representations further aid traders in making informed decisions during volatile market conditions.

Moreover, UltraAlgo's risk management features can help novice traders mitigate potential downsides associated with gamma squeezes. By setting stop-loss orders and implementing risk parameters, traders can protect their positions while participating in potentially profitable opportunities presented by gamma squeezes.

The ability to test and refine trading strategies through UltraAlgo's backtesting feature can provide novice traders with the confidence and assurance needed to navigate gamma squeezes effectively. Furthermore, the platform’s educational resources and support can empower traders with the knowledge and knowing necessary to capitalize on market opportunities while managing risks effectively.

Concluding concepts

In the dynamic world of stock trading, staying ahead of market movements and identifying profitable opportunities such as gamma squeezes can be a game-changer for traders, particularly novice ones. UltraAlgo's AI-powered algorithmic trading platform equips traders with the tools, insights, and predictive capabilities to navigate gamma squeezes and capitalize on potential market movements with confidence and precision.

By leveraging the platform's advanced features, including backtesting, real-time market data analytics, and risk management tools, novice traders can enhance their trading performance and make informed decisions in the face of gamma squeeze situations. As the market landscape continues to evolve, having the right trading platform with AI-powered capabilities becomes increasingly crucial for traders seeking to stay competitive and maximize their investment potentials.